Agarwood in 2026: Why the ‘liquid gold’ of nature is worth more than gold

Often referred to as “Liquid Gold” or the “Wood of the Gods,” Agarwood continues to rank among the most expensive natural materials in the world in 2026. Its extraordinary value is driven by extreme scarcity and a rare biological phenomenon that makes its production both unpredictable and time-intensive.

Agarwood forms only when trees from the Aquilaria species become infected by a specific fungus or suffer physical trauma. In response, the tree produces a dark, aromatic resin as a defense mechanism, the very substance that gives Agarwood its distinctive fragrance and immense worth.

Market value and pricing in 2026

Prices for Agarwood vary sharply depending on grade, resin concentration, age, and origin.

In India, high-grade Agarwood chips can command prices ranging from ₹5 lakh to over ₹10 lakh per kilogram. On the global market, ultra-rare varieties such as Kynam can exceed $100,000 per kg (around ₹85 lakh), surpassing the price of gold on a per-gram basis.

Even more valuable is Agarwood oil (Oud). In India, pure and aged Oud oil typically sells between ₹8 lakh and ₹15 lakh per liter, while premium international varieties can cross ₹5 crore per liter in luxury fragrance markets.

The global Agarwood chip market is also witnessing strong growth. Industry projections estimate expansion from approximately $10.71 billion in 2025 to over $17 billion by 2033, fueled by rising demand from the luxury fragrance, wellness, and spiritual sectors.

Why Agarwood is so expensive

Agarwood’s rarity lies in its accidental nature. Resin formation occurs in only 2–7% of wild Aquilaria trees, making naturally occurring high-grade Agarwood exceptionally scarce. Moreover, premium resin takes decades to mature, with trees often requiring 20 to 50 years to develop optimal quality.

Overharvesting has further strained supply, pushing most Aquilaria species onto the CITES endangered list, which strictly regulates international trade and elevates prices even further.

Industry trends and investment potential

To meet growing global demand, producers have increasingly turned to artificial inoculation, a method that deliberately wounds trees and introduces fungi to trigger resin production within 6 to 18 months. While faster, artificially induced Agarwood often commands lower prices than naturally aged varieties.

India’s Assam region remains one of the world’s most important Agarwood cultivation hubs. The state government is actively working to legalize and regulate the industry, which is estimated to have the potential to reach ₹50,000 crore in value.

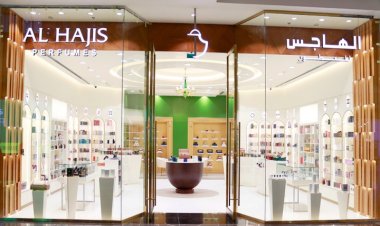

Beyond traditional strongholds such as the UAE, Saudi Arabia, and Japan, Agarwood is now gaining popularity among Western luxury perfume houses, where Oud has become a signature ingredient in exclusive, high-end fragrance lines.

A rare asset in a luxury-driven world

With limited supply, rising global demand, and deep cultural significance, Agarwood remains one of the few natural materials whose value continues to climb year after year. In 2026, it stands not just as a luxury commodity but as a rare intersection of nature, culture, and long-term investment.